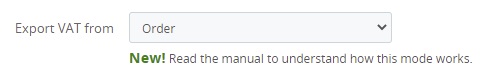

Module’s release 1.6.0 adds a new VAT export option based on the informations available within the order and no longer based on the products’ only. You can choose it by selecting the Order value for the Export VAT from menu.

Choosing this option, the following options will be hidden: Default VAT code for exported orders, VAT code for shipping costs and the Tax code mapping table. They will be replaced by the Tax rate mapping table.

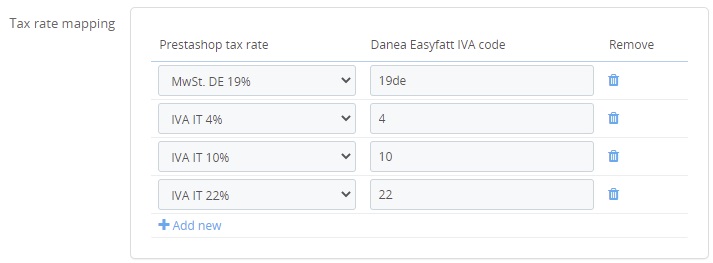

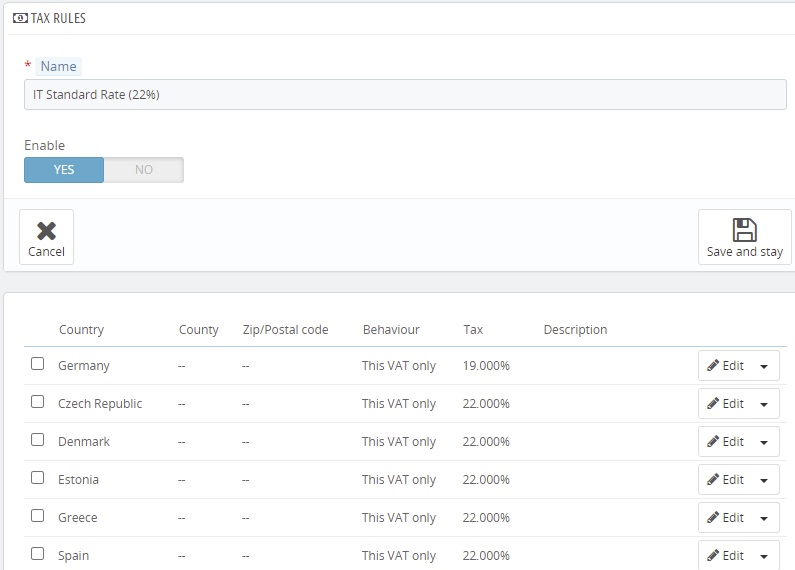

Here you will see all the different taxes currently active on the website (which can be accessed from the International -> VAT menu). In order properly export these informations you must map each VAT currently in use on the website with the respective value present within Danea Easyfatt. By clicking on the Add new button you will be abble to add one row for each tax. The result will be similar to the following one.

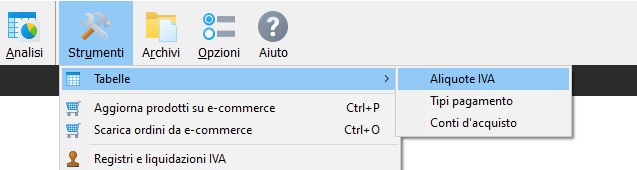

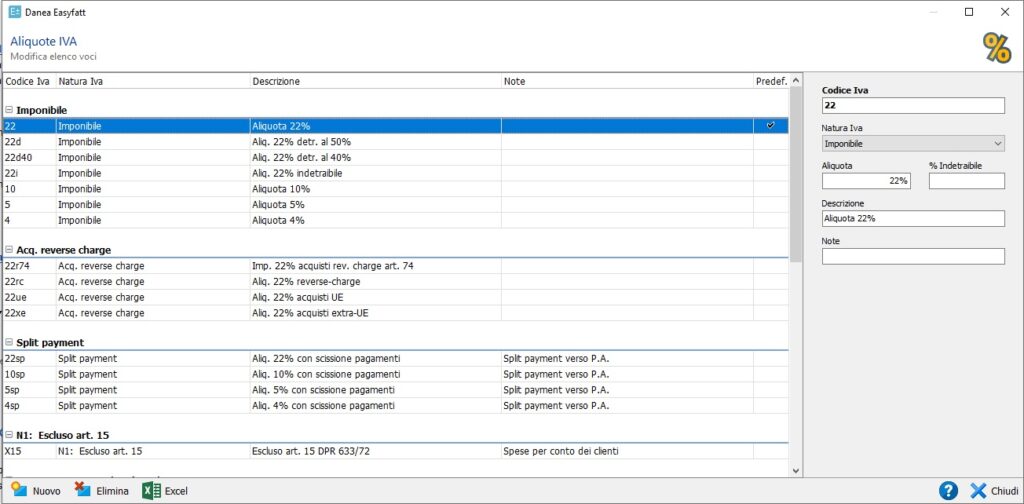

The codes you will have to enter within the Danea Easyfatt IVA code column can be recovered from Danea Easyfatt within the Aliquote IVA table. In order to show that table you can open the software and click on Strumenti -> Tabelle -> Aliquote IVA.

You will see a window similar to the following one.

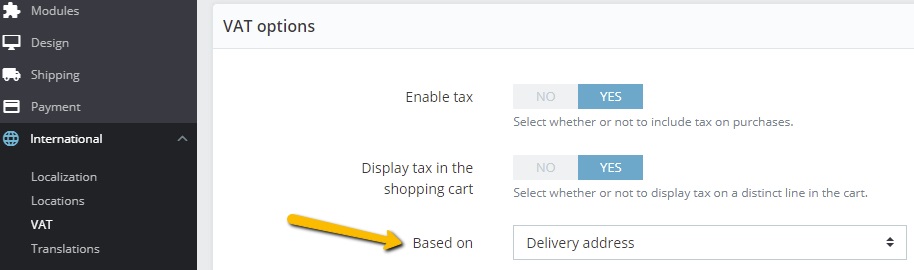

During the export process, the VAT rate will be read depending on the source selected for the Based on menu within International -> VAT -> VAT options.

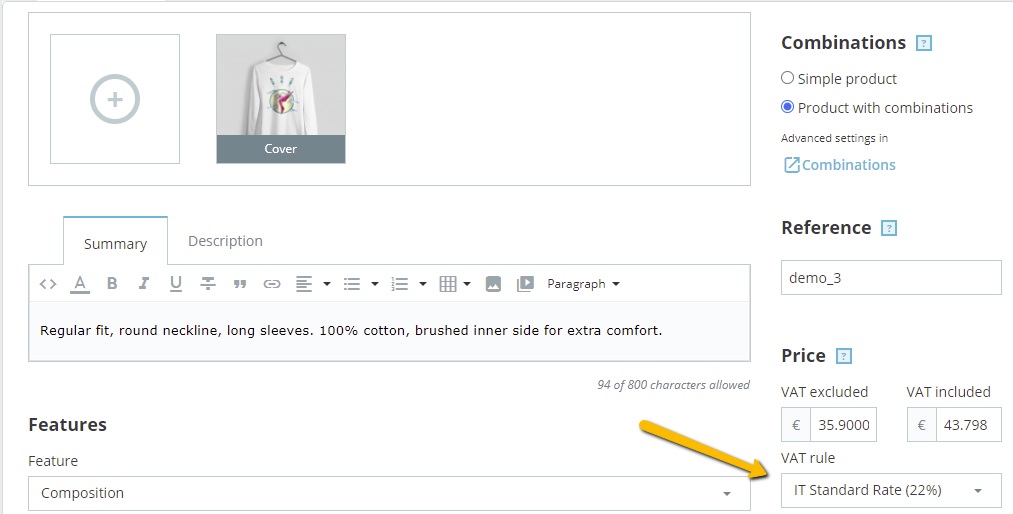

Taxes will be exported depending on the country and the tax rule associated to the product. I.E.:

This product got associated with the IT Standard Rate (22%) tax rule. Different VAT codes belong to it: you can view and modify them within the International -> VAT -> Tax rules menu on your website.

Depending on what is configured in this page, if the invoice/shipping country (depending on how you configured the option shown up here, Based on) is set to Germany, then the website will appy a 19% VAT rate. The module will then export the code associated with that tax: using as an example the image provided before (Tax rate mapping), the merchant filled in the 19de value, which will be the one exported to the file for Danea Easyfatt. Should no mapping be found, then the tax rate only will be exported (19, in this case).

In regards to shipping taxes the behavior just described is applied as well: the module will check the tax rule associated with the carrier and, depending on the delivery/invoice country, it will export the value mapped within the module or the numeric rate.

NOTA BENE: the only Behavior supported by the module is This VAT only. Nor Combine nor One after another options are currently supported.

In order to grant proper retrocompatibility, the module still lets you select the Product value for the Export VAT from menu. Choosing this option, the module will behave exactly as it did in the version prior to 1.6.0. In this case the Tax rate mapping table will be hidden and you will be provided the following options:

Default VAT code for exported orders: should a product be mapped to a tax rule not yet mapped within the module, then it will receive the code inserted here

IVA code for shipping costs: this tax will be used for shipping cost

Tax code mapping: in this table you will find the different tax rules available on the website. It is mandatory to map the code used within Danea Easyfatt to the respective tax rule

In this mode the tax code will be exported using the VAT rule set for that product. In the previous example, the product would receive the same code both for Germany and Spain, instead of keeping trace of the different VAT between the two countries.